1099g Colorado: The Essential Guide You've Been Searching For

Ever wondered what the heck 1099g Colorado is all about? Well, buckle up because we’re diving deep into this tax form that can feel like a puzzle wrapped in an enigma. If you’re a freelancer, contractor, or someone who received payments from the government, the 1099g form might just be your new best friend—or worst nightmare, depending on how you look at it. Let’s break it down, shall we?

Now, before we dive headfirst into the nitty-gritty details, let’s set the stage. The 1099g form is not just some random piece of paper you toss aside after tax season. It’s an important document that reports payments made to you by the government or other entities. In Colorado, this form plays a crucial role in ensuring you’re reporting all your income accurately. Ignoring it could lead to some serious headaches down the line.

Whether you’re a seasoned pro at filing taxes or a newbie navigating the world of freelance work, understanding the 1099g form is essential. So grab a cup of coffee (or your drink of choice), and let’s make sense of this together. Your wallet—and peace of mind—will thank you later.

Read also:Chyna Chase The Rising Star In The World Of Entertainment

What Exactly is a 1099g Form?

Let’s start with the basics. The 1099g form is essentially a tax document that reports certain types of payments you received during the year. These payments can include unemployment compensation, state or local income tax refunds, and other government payments. In Colorado, this form is particularly important for those who’ve received unemployment benefits or refunds from the state.

Here’s the deal: the IRS and state tax authorities use this form to verify that you’ve reported all your income correctly. If there’s a mismatch between what’s on your 1099g and what you report on your tax return, you might end up with a letter from the IRS—or worse, an audit. Yikes!

Key Features of the 1099g Form

- Reports unemployment compensation and other government payments

- Used by the IRS and state tax authorities to verify income

- Important for freelancers, contractors, and anyone who received government payments

Why Does the 1099g Form Matter in Colorado?

Colorado has its own set of tax rules and regulations, and the 1099g form fits right into that puzzle. If you’ve received unemployment benefits or a tax refund from the state, this form ensures that you’re reporting everything accurately. It’s like a safety net to make sure you’re not leaving any income unreported—or overpaying taxes.

Here’s a quick rundown of why the 1099g form matters in Colorado:

- Helps you avoid penalties and interest for underreporting income

- Ensures you’re eligible for any tax credits or deductions

- Keeps your tax records organized and up-to-date

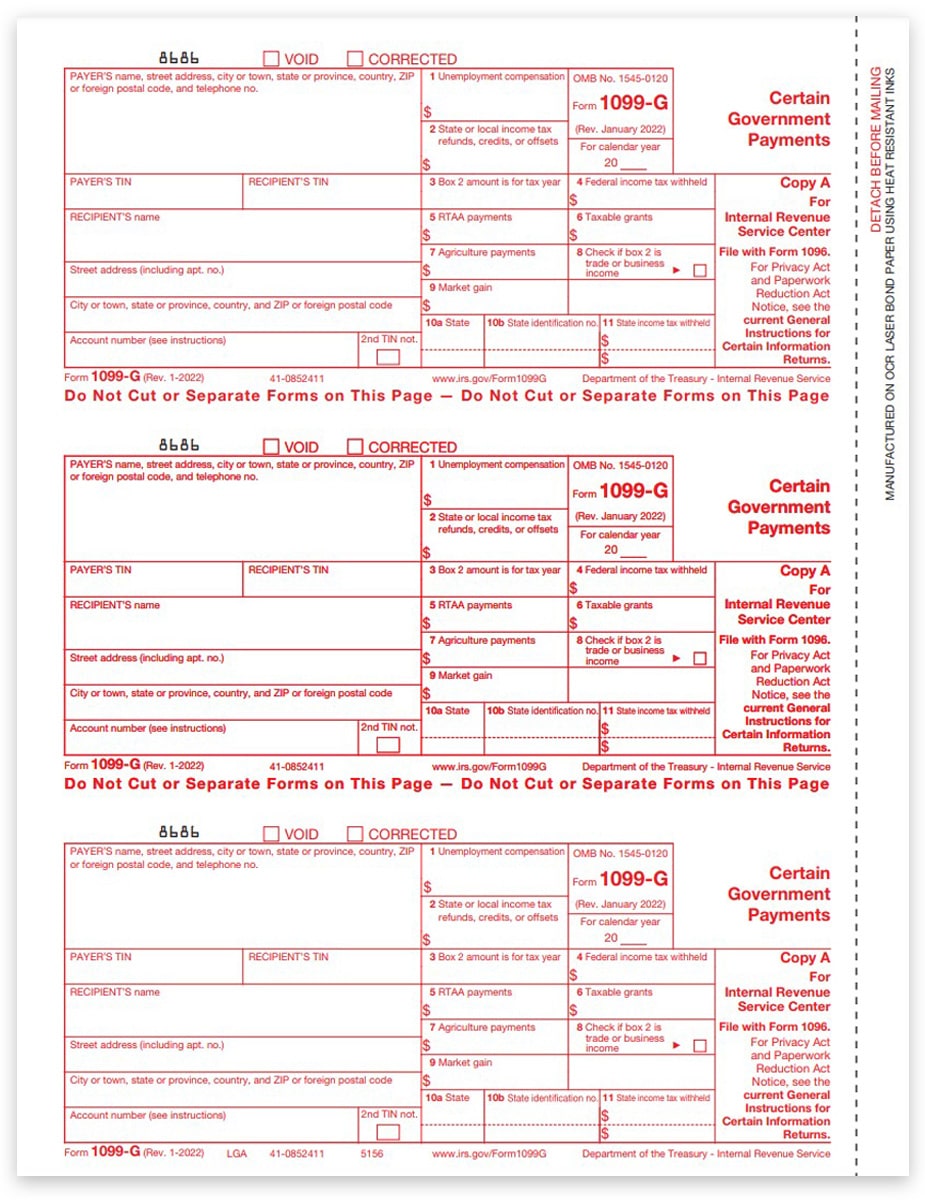

How to Read Your 1099g Form

Deciphering tax forms can feel like trying to read hieroglyphics, but don’t worry—we’ve got you covered. The 1099g form has several key sections that you need to pay attention to. Let’s break it down:

Boxes You Need to Know

- Box 1: Total payments made to you during the year

- Box 2: Unemployment compensation

- Box 3: State or local income tax refunds

Each box provides specific information that you’ll need to include on your tax return. Make sure to double-check these numbers before filing to avoid any discrepancies.

Read also:Darla Crane The Iconic Figure Redefining Modern Success

Common Mistakes to Avoid

Tax season can be stressful, and mistakes happen. But some errors are more common than others, especially when it comes to the 1099g form. Here are a few pitfalls to watch out for:

- Forgetting to include all income reported on the 1099g

- Misreporting unemployment compensation

- Not accounting for state tax refunds

Take your time when reviewing your 1099g form, and don’t hesitate to reach out to a tax professional if you’re unsure about anything.

How to File Your 1099g Form

Filing your 1099g form doesn’t have to be a daunting task. Whether you’re using tax software or filing manually, here’s what you need to do:

Step-by-Step Guide

- Gather all your 1099g forms

- Match the numbers on your forms with your tax return

- Include any necessary adjustments, such as unemployment compensation or tax refunds

- Double-check your calculations before submitting

By following these steps, you’ll ensure that your tax return is accurate and complete.

Tax Implications of the 1099g Form

Now, let’s talk about the tax implications of the 1099g form. Depending on the type of payments reported, you might owe additional taxes—or you might qualify for certain deductions. Here’s what you need to know:

- Unemployment compensation is generally taxable at the federal level

- State tax refunds may be taxable if you claimed a deduction for state taxes in a previous year

- Other government payments may have specific tax rules, so it’s important to review them carefully

Consulting with a tax advisor can help you navigate these complexities and ensure you’re maximizing your tax benefits.

How to Handle Unemployment Compensation

If you’ve received unemployment benefits, the 1099g form is your go-to document for reporting this income. Here’s how to handle it:

Tips for Reporting Unemployment Compensation

- Include the amount from Box 2 on your federal tax return

- Check if your state taxes unemployment benefits

- Consider any deductions or credits you might qualify for

Unemployment benefits can be a lifeline during tough times, but they do come with tax obligations. Stay informed to avoid any surprises.

State Tax Refunds and the 1099g Form

Got a state tax refund last year? The 1099g form will report that amount, and it might affect your current tax return. Here’s what you need to know:

- Refunds are generally not taxable if you didn’t itemize deductions in the previous year

- If you did itemize, you might need to include part of the refund as income

- Consult your tax software or a professional for guidance

State tax refunds can be tricky, so make sure you understand the rules before filing.

Resources for Understanding the 1099g Form

Still feeling a bit lost? Don’t worry—there are plenty of resources available to help you make sense of the 1099g form. Here are a few we recommend:

- IRS Form 1099g Guide

- Colorado Department of Revenue

- TaxSlayer or TurboTax for tax preparation software

These resources can provide additional insights and support as you navigate the world of tax forms.

Kesimpulan

So there you have it—a comprehensive guide to the 1099g form in Colorado. From understanding what it is to avoiding common mistakes, we’ve covered everything you need to know to file your taxes confidently. Remember, accuracy is key when it comes to tax forms, so take your time and double-check everything before submitting.

Now, here’s the call to action: leave a comment below if you found this article helpful, and don’t forget to share it with anyone who might benefit from it. And if you’re still feeling unsure, consider consulting with a tax professional to ensure you’re on the right track. Your peace of mind is worth it!

Daftar Isi

- What Exactly is a 1099g Form?

- Why Does the 1099g Form Matter in Colorado?

- How to Read Your 1099g Form

- Common Mistakes to Avoid

- How to File Your 1099g Form

- Tax Implications of the 1099g Form

- How to Handle Unemployment Compensation

- State Tax Refunds and the 1099g Form

- Resources for Understanding the 1099g Form

- Kesimpulan

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)