Colorado 1099G: Your Ultimate Guide To Understanding The Basics And Beyond

Alright folks, let’s dive into the nitty-gritty of Colorado 1099G. If you’ve received one of these forms in the mail or seen it pop up on your tax software, chances are you’ve got some questions swirling around in your head. What exactly is this 1099G thing? Why does Colorado have its own version? And most importantly, how does it affect your taxes? Well, buckle up because we’re about to break it all down for you.

First off, the 1099G form is a tax document that reports certain types of income you might’ve received during the year. In Colorado, it’s particularly important if you’ve gotten any payments from the state government, like unemployment benefits, tax refunds, or other government-related income. So yeah, it’s kinda a big deal when it comes to filing your state taxes.

Now, don’t freak out if you see a 1099G in your mailbox. It’s not some scary IRS letter or anything. Instead, it’s just a heads-up from the government saying, “Hey, here’s what we paid you last year, and guess what? It’s taxable.” But don’t worry—we’ll walk you through everything you need to know so you can handle it like a pro.

Read also:Tina Campbell The Voice That Redefines Gospel Music

So why is the Colorado 1099G so important? Well, let’s just say it’s one of those forms that can make or break your tax return. If you ignore it or mess it up, you could end up owing more money to the state—or even worse, face penalties. But if you play your cards right, you’ll be good to go. Let’s get started, shall we?

What Exactly is the Colorado 1099G?

Alright, let’s start with the basics. The Colorado 1099G is essentially a report card for any income you’ve received from the state government. It’s sent out by entities like the Colorado Department of Labor and Employment, the Colorado Department of Revenue, or any other state agency that might’ve cut you a check during the year. Think unemployment benefits, state tax refunds, or even payments from government programs.

Here’s the deal: when you file your taxes, the IRS and the Colorado Department of Revenue want to make sure all the income you report matches what these agencies say you received. That’s where the 1099G comes in. It’s like a little cheat sheet that helps you fill out your tax forms correctly.

Now, here’s the kicker—just because you received a 1099G doesn’t mean all of that money is taxable. Some of it might be exempt, depending on your situation. For example, if you received unemployment benefits, a portion of that could be tax-free. But more on that later. For now, just remember that the 1099G is your friend, not your enemy.

Why Colorado Has Its Own 1099G

You might be wondering, “Why does Colorado have its own version of the 1099G? Isn’t the federal one enough?” Great question. The truth is, state governments often have their own rules and regulations when it comes to taxes. While the federal 1099G covers payments from the federal government, the Colorado version focuses specifically on state-related income.

For instance, if you got a state tax refund last year, that’s going to show up on your Colorado 1099G. Same goes for unemployment benefits paid by the state. It’s all about keeping things organized and making sure everyone pays their fair share—or gets credit for overpaying, as the case may be.

Read also:Karen Yuzuriha The Rising Star Shining Bright In The Entertainment World

Plus, Colorado has its own unique tax laws that don’t always align with federal rules. So having a separate 1099G form helps ensure everything is accounted for correctly. It’s like having a personalized tax roadmap just for Colorado residents.

Who Gets a Colorado 1099G?

Not everyone in Colorado will receive a 1099G. It’s only issued to individuals who’ve received certain types of payments from the state government. Here’s a quick rundown of who might get one:

- Unemployment benefit recipients

- People who received state tax refunds

- Individuals who got payments from government programs, like grants or subsidies

- Anyone who received forgiveness of debt from a state agency

So if you fall into any of those categories, chances are you’ll see a 1099G in your mailbox—or your email inbox, depending on how the state prefers to send them these days. And if you don’t get one but think you should’ve, don’t panic. You can always reach out to the issuing agency to double-check.

Common Misconceptions About the Colorado 1099G

There are a few myths floating around about the Colorado 1099G that we need to clear up. First off, some people think it’s only for unemployment benefits. Not true! As we mentioned earlier, it can also cover tax refunds, grants, and other types of income.

Another misconception is that receiving a 1099G automatically means you owe more taxes. Not necessarily. Like we said before, some of the income reported on the form might be exempt. It all depends on your specific circumstances and the rules set by the state.

Finally, some folks believe that ignoring the 1099G will make it go away. Spoiler alert: it won’t. If you disregard this form, you could end up with some serious tax trouble on your hands. So don’t stick it in a drawer and forget about it. Take the time to understand it and incorporate it into your tax filing process.

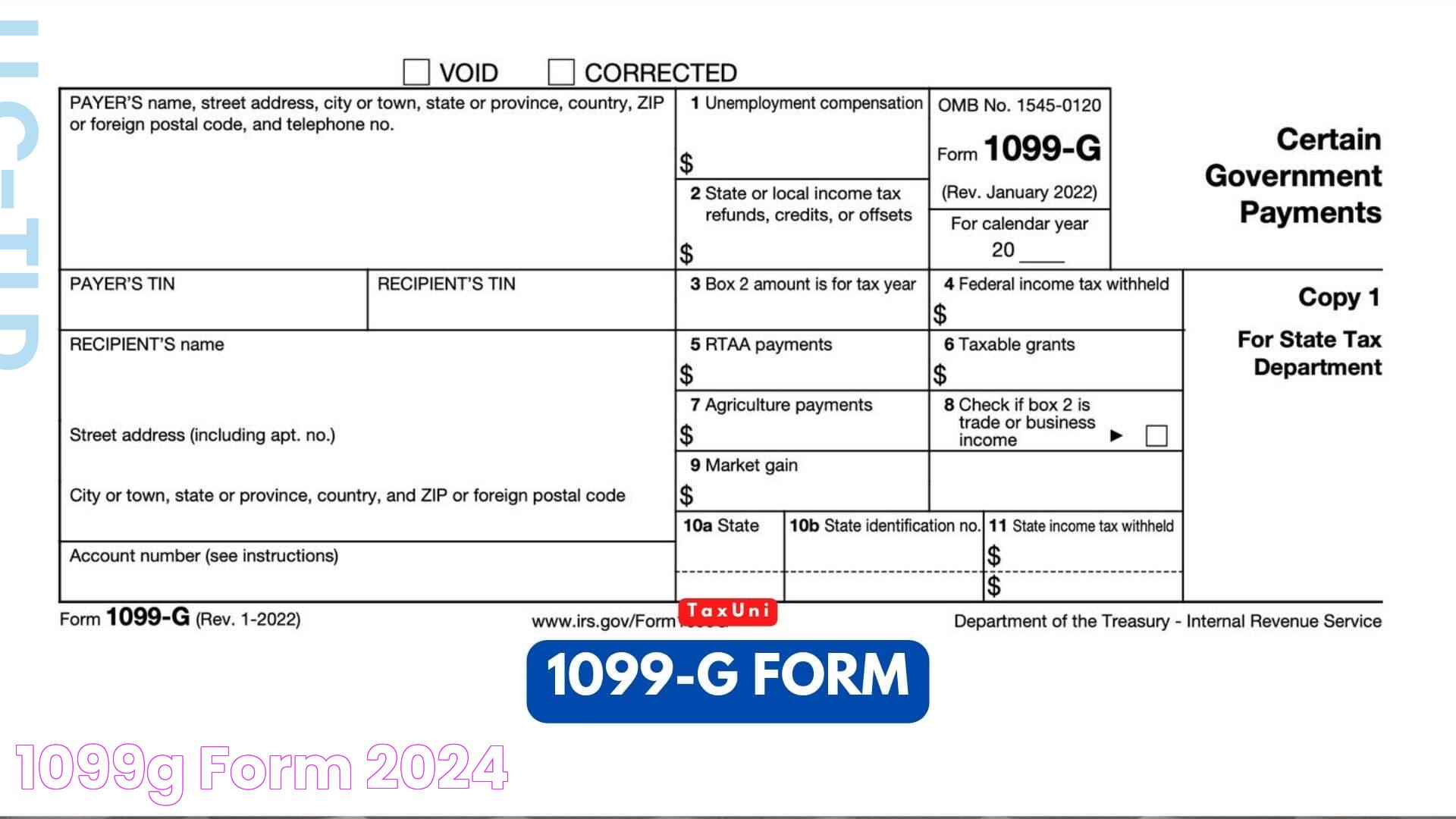

How to Read Your Colorado 1099G

Now that you know what the Colorado 1099G is and who gets one, let’s talk about how to actually read it. At first glance, it might look like a bunch of numbers and codes, but once you break it down, it’s pretty straightforward.

Here are the key sections you’ll find on your form:

- Box 1: Total Payments – This shows the total amount of payments you received from the state government.

- Box 2: Federal Income Tax Withheld – If any federal taxes were withheld from your payments, they’ll be listed here.

- Box 3: State Income Tax Withheld – Same as above, but for state taxes.

- Box 4: Unemployment Compensation – If you received unemployment benefits, the amount will be here.

- Box 5: Other Income – This is where any other types of income, like grants or subsidies, will be reported.

As you can see, each box corresponds to a different type of payment. By carefully reviewing each section, you can ensure you’re reporting everything accurately on your tax return.

What to Do if You Disagree With Your 1099G

Let’s say you take a look at your Colorado 1099G and something doesn’t seem right. Maybe the numbers don’t match what you actually received, or perhaps there’s a payment listed that you never got. What do you do?

First, don’t panic. Mistakes happen, and they’re usually easy to fix. Start by contacting the agency that issued the form. They’ll be able to review your account and make any necessary corrections. In some cases, they might even send you an amended 1099G.

And if you’re still having trouble, don’t hesitate to reach out to a tax professional. They can help you navigate the process and ensure everything gets sorted out before you file your taxes.

Tax Implications of the Colorado 1099G

Now we get to the meat of the matter—how the Colorado 1099G affects your taxes. As we’ve mentioned, not all of the income reported on the form is taxable. Here’s a breakdown of what you need to know:

- Unemployment Benefits – While unemployment benefits are generally taxable, there are some exceptions. For example, if you lived in a federally declared disaster area, a portion of your benefits might be exempt.

- Tax Refunds – If you received a state tax refund, it might be taxable depending on how much you claimed as a deduction last year. Confusing, right? Don’t worry—we’ll explain more in a bit.

- Grants and Subsidies – These are usually not taxable, but there are always exceptions. Check with the issuing agency to be sure.

It’s important to note that the rules can vary depending on your individual situation. That’s why it’s crucial to review your 1099G carefully and consult with a tax expert if you’re unsure.

Strategies for Minimizing Your Tax Liability

Of course, no one wants to pay more taxes than they have to. Luckily, there are some strategies you can use to minimize your tax liability when it comes to the Colorado 1099G.

First, make sure you’re claiming all the deductions and credits you’re entitled to. For example, if you itemize your deductions, you might be able to reduce your taxable income. And if you qualify for any tax credits, like the Earned Income Tax Credit, be sure to claim them.

Another tip is to keep detailed records of all your income and expenses throughout the year. This will make it easier to accurately report everything on your tax return and avoid any nasty surprises.

How to File With a Colorado 1099G

Alright, let’s talk about the actual filing process. If you’ve received a Colorado 1099G, you’ll need to include the information from the form when you file your state tax return. Here’s how to do it:

- Gather all your tax documents, including your 1099G.

- Input the information from your 1099G into your tax software or tax forms.

- Double-check everything to make sure it’s accurate.

- Submit your tax return by the deadline.

It’s really that simple. Of course, if you’re using a tax professional, they’ll handle all the details for you. But even if you’re doing it yourself, most modern tax software makes the process a breeze.

Common Mistakes to Avoid

While the filing process is pretty straightforward, there are a few common mistakes people make when dealing with their Colorado 1099G. Here are a few to watch out for:

- Forgetting to include the 1099G information on your tax return.

- Misreporting the amounts from the form.

- Not claiming all the deductions and credits you’re eligible for.

By being aware of these pitfalls, you can avoid them and ensure a smooth filing process.

Conclusion: Take Control of Your Colorado 1099G

And there you have it—your ultimate guide to understanding the Colorado 1099G. Whether you’re dealing with unemployment benefits, tax refunds, or other types of income, this form plays a crucial role in your tax filing process. So don’t let it intimidate you. Instead, use it as a tool to ensure you’re reporting everything accurately and taking advantage of all the deductions and credits you’re entitled to.

Remember, if you ever feel overwhelmed or unsure, don’t hesitate to reach out to a tax professional. They can help you navigate the complexities of the 1099G and make sure you’re on the right track.

Now it’s your turn. Have you received a Colorado 1099G this year? How did you handle it? Let us know in the comments below. And if you found this guide helpful, be sure to share it with your friends and family. After all, tax season is a team effort!

Table of Contents

- What Exactly is the Colorado 1099G?

- Why Colorado Has Its Own 1099G

- Who Gets a Colorado 1099G?

- How to Read Your Colorado 1099G

- Tax Implications of the Colorado 1099G