Understanding Colorado 1099-G: A Comprehensive Guide For Taxpayers

Let’s face it, folks, taxes can be as confusing as a maze, but when it comes to Colorado 1099-G, you’re gonna wanna stick around because this is big stuff. If you’ve ever received a 1099-G form, you know it’s not just another piece of paper—it’s an important document that could affect your tax return. So, buckle up, because we’re diving deep into everything you need to know about the Colorado 1099-G form and how it impacts your finances.

Now, before we get too far ahead of ourselves, let’s set the scene. The 1099-G form is essentially a report card for any payments you might have received from state or local governments. Whether it’s unemployment benefits, refunds, or other government-related payments, the 1099-G has got you covered. And if you’re in Colorado, well, this form is your key to making sure you don’t miss out on any deductions or credits you’re entitled to.

Here’s the deal: Colorado 1099-G isn’t just a fancy name; it’s a lifeline for taxpayers who want to make sure their tax filings are accurate and compliant. By the end of this guide, you’ll be armed with the knowledge to tackle your taxes like a pro. Let’s roll!

Read also:Kate Todd The Untold Story Of A Remarkable Life

What Exactly is the Colorado 1099-G Form?

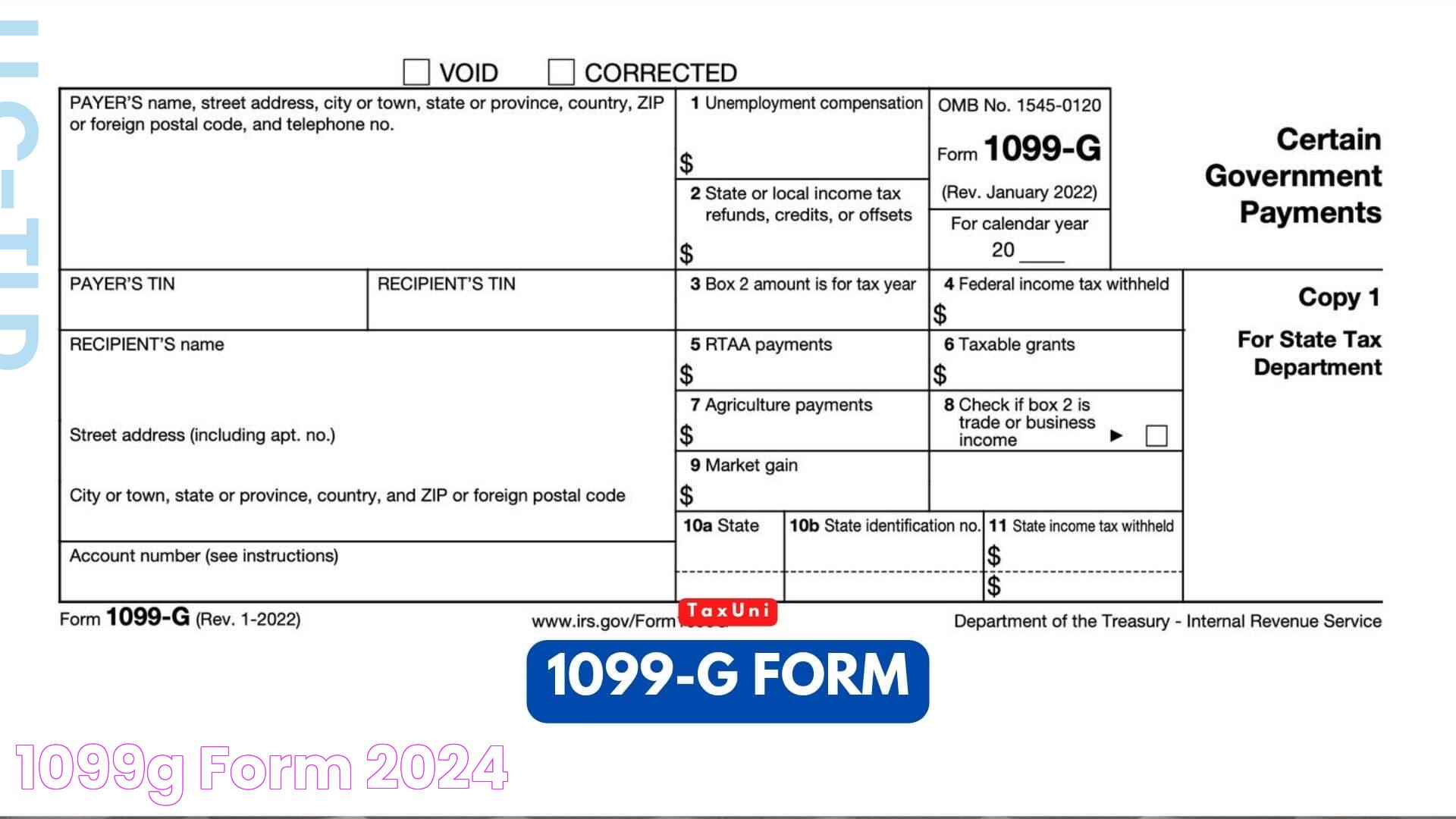

Alright, let’s break it down. The Colorado 1099-G form is a tax document issued by the state of Colorado to individuals who have received payments from the government during the tax year. These payments could include unemployment compensation, state tax refunds, or other government benefits. Think of it as a detailed receipt that helps you track all the money you’ve received from the government.

Here’s a quick rundown of what the form typically includes:

- Unemployment benefits you’ve received

- State or local tax refunds

- Any other government-related payments

Why does this matter? Because if you don’t report these payments correctly, you might end up owing more taxes or even facing penalties. So, yeah, it’s kinda important.

Why is the 1099-G Form Important for Colorado Taxpayers?

Let’s be real, folks, tax season can be stressful, but having the right information makes all the difference. The 1099-G form is crucial because it ensures that you’re reporting all your income accurately. If you’ve received unemployment benefits, for example, failing to include them on your tax return could lead to big trouble.

Here’s the kicker: Even if you think the payments you received aren’t taxable, the IRS and Colorado Department of Revenue might beg to differ. That’s why the 1099-G is your safety net. It provides a clear breakdown of what you’ve received and what you need to report. No guessing games here!

Breaking Down the Details: What’s on the Form?

Alright, so what exactly do you find on the Colorado 1099-G form? Let’s take a closer look:

Read also:Chloe Radcliffe Rising Star Of The Digital Age

- **Box 1:** Total payments from state or local governments

- **Box 3:** Unemployment compensation

- **Box 5:** State tax refunds or credits

Each box gives you specific details about the payments you’ve received. For instance, if you got a state tax refund last year, it’ll show up in Box 5. Makes sense, right?

Common Misconceptions About the Colorado 1099-G

There’s a lot of confusion floating around about the 1099-G form, so let’s clear the air. One common misconception is that unemployment benefits aren’t taxable. Newsflash: They are! Another myth is that you don’t need to report state tax refunds unless they’re above a certain amount. Wrong again! Every cent counts when it comes to taxes.

Here’s a quick myth-busting checklist:

- Unemployment benefits are taxable at the federal level

- State tax refunds must be reported if they exceed your itemized deductions

- All payments listed on the 1099-G form should be included in your tax return

So, don’t fall for the hype. Stick to the facts and you’ll be golden.

How to File Your Colorado 1099-G Form

Alright, now that you know what the form is and why it matters, let’s talk about how to file it. First things first, make sure you have all your documents in order. You’ll need your W-2s, other 1099 forms, and, of course, your 1099-G.

Here’s a step-by-step guide:

- Gather all your tax documents

- Review the 1099-G form carefully

- Input the information into your tax return software or file manually

- Double-check for accuracy

Pro tip: Use tax software like TurboTax or H&R Block to simplify the process. They’ll walk you through everything and even double-check your work for errors.

What Happens If You Don’t File Your 1099-G?

Skipping the 1099-G might seem like an easy way out, but trust me, it’s not worth it. If you fail to report the payments listed on the form, you could face penalties, interest charges, or even an audit. The IRS and Colorado Department of Revenue take these forms very seriously, so it’s best to play it safe.

Key Deadlines to Remember

Deadlines are like that one annoying alarm clock that won’t stop ringing. But hey, they’re important! For the Colorado 1099-G form, the key deadline is typically the same as your federal tax return deadline—April 15th. However, if you need more time, you can request an extension. Just don’t forget to file eventually!

What If You Miss the Deadline?

Missing the deadline isn’t the end of the world, but it can lead to some headaches. You might face late filing penalties or interest on any taxes owed. The best course of action is to file as soon as possible to minimize the damage.

Who Needs to File the Colorado 1099-G?

Not everyone needs to file a 1099-G form, but if you’ve received any payments from the government, chances are you do. This includes:

- Unemployment recipients

- Taxpayers who received state tax refunds

- Anyone who received government benefits

If you’re not sure whether you need to file, check with a tax professional or consult the IRS website. Better safe than sorry!

Tips for Navigating the Colorado 1099-G Process

Now that you’ve got the basics down, here are a few tips to make the process smoother:

- Keep all your tax documents in one place

- Use tax software to simplify filing

- Double-check your math to avoid errors

- Consult a tax professional if you’re unsure

Remember, the goal is to make your life easier, not harder. These tips will help you stay organized and stress-free during tax season.

How Can a Tax Professional Help?

Let’s face it, taxes can be complicated, and sometimes you just need an expert to guide you through the process. A tax professional can help you understand the nuances of the Colorado 1099-G form, ensure you’re reporting everything correctly, and even find deductions or credits you might have missed.

Final Thoughts and Next Steps

Alright, we’ve covered a lot of ground here, folks. From understanding what the Colorado 1099-G form is to navigating the filing process, you’re now equipped with the knowledge to tackle your taxes head-on. Remember, accuracy is key, and don’t hesitate to seek help if you need it.

Here’s a quick recap:

- The Colorado 1099-G form is crucial for reporting government payments

- Unemployment benefits and state tax refunds must be reported

- Use tax software or consult a professional for assistance

Now, it’s your turn. Take action by gathering your documents, reviewing your 1099-G form, and filing your taxes on time. And if you found this guide helpful, don’t forget to share it with your friends and family. Together, we can make tax season a little less stressful!

Table of Contents

- What Exactly is the Colorado 1099-G Form?

- Why is the 1099-G Form Important for Colorado Taxpayers?

- Breaking Down the Details: What’s on the Form?

- Common Misconceptions About the Colorado 1099-G

- How to File Your Colorado 1099-G Form

- What Happens If You Don’t File Your 1099-G?

- Key Deadlines to Remember

- Who Needs to File the Colorado 1099-G?

- Tips for Navigating the Colorado 1099-G Process

- Final Thoughts and Next Steps